Where should I put my stop? That is the question people always ask us.

The answer is simple, but at the same time it’s complicated:

You need to put your stop where it won’t get hit.

Let’s look at today to see exactly what we mean.

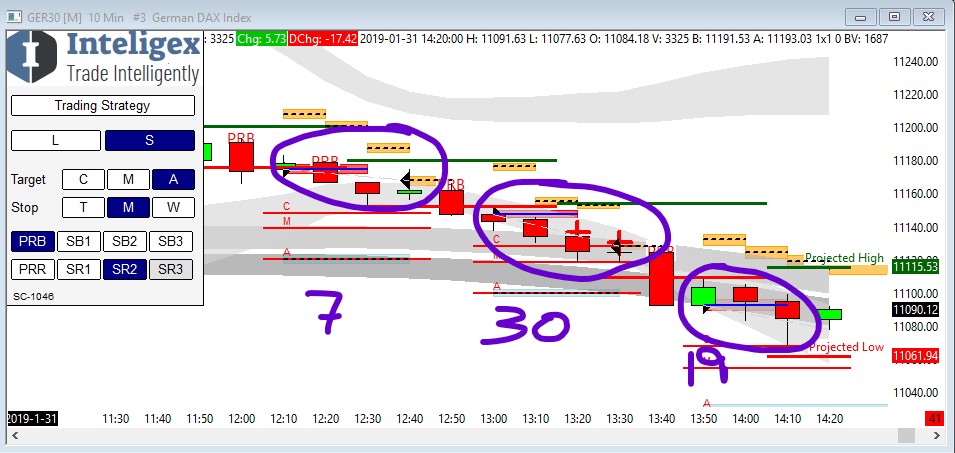

This is the Dax this morning (31 January 2019). Fully automatic trades on the 10 minute chart (which we love for the Dax). No human intervention.

Trade one – 7 point profit after all commissions, but stopped by a small blip over lunch.

Trade two – 30 points profit, but again stopped by a small blip at 1330. Again over lunch.

Trade three – 19 points, hitting our target at 1410, just after lunch is over.

Inteligex did exactly what we asked of it, and returned 56 points of Dax profit which is EUR1400 of profit on a single full contract or EUR280 on a mini-contract. All in all a great lunchtime trading, and although we ended up with three trades and not one, Inteligex did exactly what we needed. It even put us back into the trade twice. As soon as the algos calculated there was more profit to have, Inteligex triggered those trades.

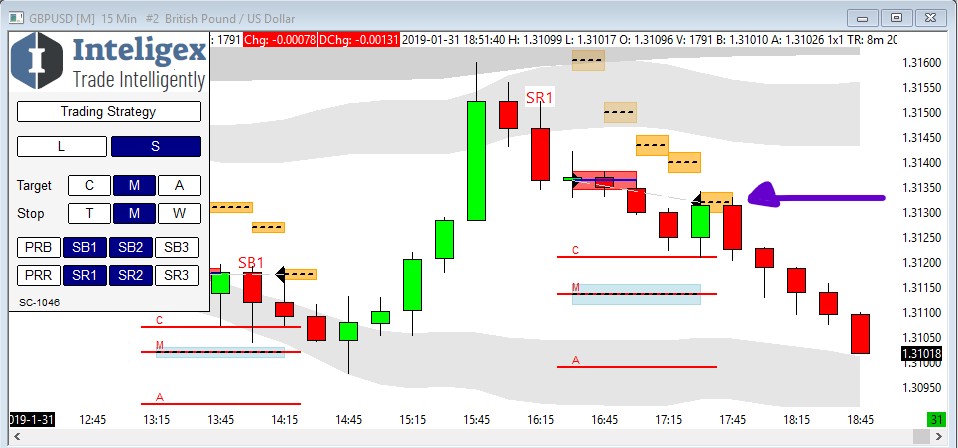

Now to a Forex trade, and pure frustration for us.

This is the short side of GBPUSD today, two trades and between them only 14 pips. Irritatingly we get stopped on both occassions by a single volatile candle… meaning we missed out on another 50 pips. Annoying, but statistically it’s still the right thing to do.

Now a lot of traders worry about this, but Inteligex traders don’t.

Why? Because we’d already taken 38 pips on Cable in the run up to the short above. Beautiful trading, right from entry to our target. We took the middle right out of the trade and finished the day on 52 pips profit. #happy