The Diamond release of Inteligex is the result of over 300+ additional man days investment in the core Inteligex Trading System. It follows a complete review of historic trades by market, timeframe, trade type and time of day.

Inteligex combines machine learning, powerful mathematical modelling, trading algorithms and real world market insight. Each evolution of Inteligex is a step forward in helping you trade profitably no matter what the market conditions. Inteligex Diamond is the next step forward in the evolution of the powerful Inteligex trading tool.

Inteligex Diamond is tuned to work on key US Futures Markets (e-mini): Nasdaq, Dow, S&P and Russell2000. New releases will be optimised for additional markets. Make sure you Sign-Up to our newsletter to be the first to hear!

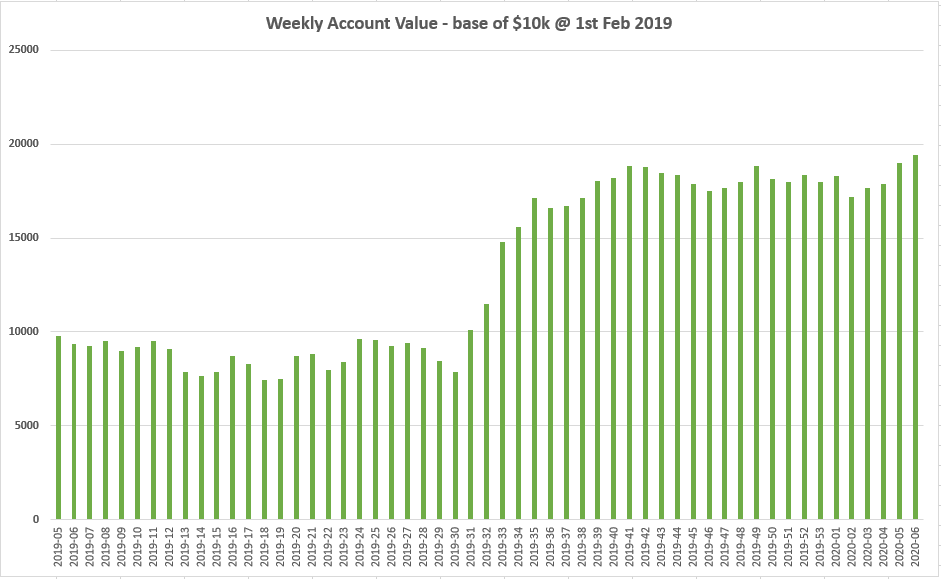

The Backtest results on trading a $10,000 account over 12 month on the e-mini ES (1st February 2019 to 7th February 2020) shows a superb increase in account size to $19,450. This is a per annum growth of almost 100%, now that’s better than Hedge Fund performance!

Each bar on the chart represents one week of trading with results added or debited against the starting account size of $10,000. Broker fees are assumed as $2.50 per side and assigned to each side of the trade.

For those of you wanting to take a deeper dive the attached spreadsheet shows every single trade taken (603) and the corresponding week. The change to the overall account size includes the $5 round trip for trade and each trade value is gross i.e. no broker fees.

Watch this space for more Inteligex backtest results and for more information contact info@gator3003.temp.domains.