Now that Thanksgiving is out of the way we have 3 full weeks of Trading left in 2019.

The question is will there be a Santa Rally or a Santa Crash on the Financial Markets? We all remember the market dip last December when the S&P 500 alone lost c. 9% and that makes this time around particularly interesting!

So what do we as Day Traders do? What’s the case for and against and what do we think at Inteligex?

There will be a December market rally!

It has been a meteoric year for the US markets, a continual grind upwards with record highs across Nasdaq, Dow and the S&P markets.

The economic news has shown many signs of potential uncertainty: China Tariffs, European Tariffs, Impeachment Hearings, Brexit, Overvalued Businesses crashing off their IPO highs …… to name but a few, but the markets just seem to be shrugging this off.

If you listened to some market commentary you would have moved a proportion of assets into cash some time ago and you would have lost out on the gain. That’s no fun and no amount of people saying it was sensible risk management makes it any easier!

The bottom line here is that there seems to be a lot of investor money chasing the potential return on equities and there is not much return to be had in bonds.

Interest rates are low and this combined with high rates of employment should continue to drive positive consumer sentiment which means more purchases of goods and services which in turn drives the economy forward.

Additionally, the very low interest rates are creating what is called a TINA for equities. TINA? Simple really – There Is No Alternative. No alternative to stocks if you want a decent return.

The news so far has not wobbled the markets so why should it do so now?

There will be a December market crash!

Inherently financial markets don’t like uncertainty. The US – China trade deal discussions could have a significant medium to long term impact on both markets and these two markets are the two key drivers of the Global Economy. In fact trade tariff discussions are ongoing with almost all major trading blocks to the US, further increasing trading uncertainty.

In addition company valuations are looking high, particularly for some big companies that aren’t yet profitable and this has also been reflected in the lacklustre performance of some 2019 IPOs.

The reality is at some point financial investors will want to take some of their healthy 2019 gains off the table. This is the longest running bull market in history and the laws of probability say that it must come to an end.

The last time this happened we had a chap called Greenspan saying …how do we know when irrational exuberance has unduly escalated asset values? (that’s posh speak for saying ‘how do we know if the market is overvalued) ….. and how did that end?

Not well as it happens! The Nasdaq tumbled from a peak of 5,048.62 on March 10, 2000, to 1,139.90 on Oct 4, 2002, a 76.81% fall. Now we’re not saying that will happen again but …. never say never.

The Inteligex view

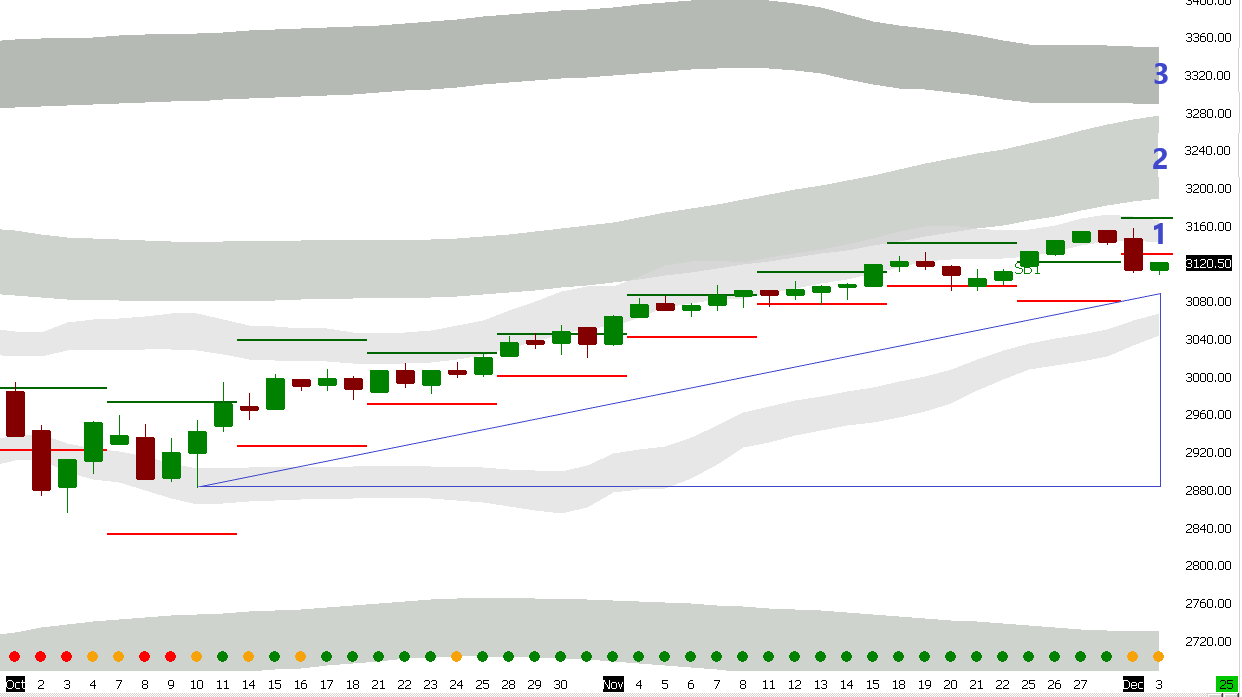

As those of you who follow Mark’s Markets will know, all 3 US markets are butting up against our 3 upper swarm bands. These are lines of resistance and when they’re close together like they are now it makes them particularly likely to repel and push the price lower.

The graph below shows the S&P e-Mini index with the ongoing rise and 3 swarm bands converging.

This means we believe we are expecting a correction. Our guess would be something in the order of 10% in the next few months. We do not have a crystal ball, it’s just our view!

However at Inteligex we’re Day Traders so we just need a good volume of trades and some volatility. Then we set our daily settings according to market conditions and let the algo trading capability of Inteligex identify our trades.

To be honest the onward grind upwards across the last two quarters of the year haven’t given us as many opportunities as we’d have liked.

What we’d really like for Christmas is more price movement and so if we get the same pattern as last year that would suit us just fine!