The German economy has been in the news a lot recently, be it about tariffs applied to auto imports to the US, a slowing in industrial output and narrowly avoiding recession or the decision for Tesla to put a factory in Berlin.

If you want to start getting more diversification in your trading then the German Dax is a good place to look as your first stop outside of the US.

What is the Dax?

The Dax is an index based on the top 30 German businesses, it works in a similar way to the Nasdaq index. It is available as a mini-DAX future at a price of €5 (just over $5.50) per contract so well within the reach of most day traders (for comparison an e-mini YM contract is $5).

Why should I care?

Whichever way you read the news, the German economy is very important. It’s the 4th largest GDP in the world (5th when converted using currency parity) and Europe’s largest industrial producer. Manufacturing may not be as sexy as tech but these are well run business providing solid numbers year in and year out and Germany also has strong businesses in Chemicals, Financial Services, Semiconductors and Software. Being Germany you also get clear, honest economic data that you can trust which can’t be said for all parts of the world.

Trading the DAX also allows you to extend your trading day as the Dax opens at 9am local time which is the equivalent of 3am EST!

So I’m interested, what should I do?

At Inteligex we trade the DAX every day as you’ll have seen from our daily Mark’s Market videos. We wanted something to balance our US trading and we’ve found that the volume and the volatility of the DAX works really well with the Inteligex algorithims.

We suggest that you add it to a chart (you’ll need a Eurex data feed) and monitor it daily, also take a look at our daily videos and you’ll see a report on each morning session. Once you’re comfortable running in simulation mode then you can think about moving to live trading. We like it on 3 minute candles.

What results should I expect?

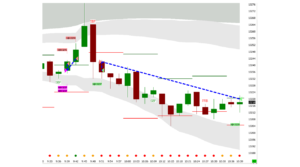

Well I’m glad you asked that as I can show you a beautiful first hour trading from today. I’m currently running 2 contracts per trade, 1 on bank and 1 on target. We take a long trade trade at 9.39 am which completes within 2 candles netting us 11 pts. Then over the next two candles there is a steep rise and corresponding drop (a nightmare for manual traders!) before the system enters us into a short trade.

The short trade takes a bank within the first candle and then carries on running with the other contract until it is stopped out some 40 minutes later giving us a further 27 pts. That’s 38 points ($265) within the first hour of trading.

How do I know when to stop trading?

At Inteligex we are not greedy traders, once we have a profit of +$200 in a market on the day we will stop trading. No more thinking about it, it’s out of our heads and we can focus on setting up for the US sessions. Inteligex allows you to remove emotion from your Trading decisions.

A closer look at the swarms tells you this is also the right thing to do. You can see that they start to get a lot tighter which means that there is going to be less movement later in the session. You can also see that if you had carried on trading a small loss would be incurred taking 8 pts out of your overall gain so why risk it?

What should I do next?

If you’re interested in trading the DAX we suggest:

- Watch Mark trading the DAX on a daily basis via our Mark’s Markets videos

- Get a Eurex data feed and add the DAX symbol and watch how it behaves

- Move to live trading when you’re happy with your simulated results and have a clear strategy and risk profile