Preserving Capital

Hey Traders!

I’ve been trading for about an hour a day this week and then trying to stay away from my charts. There are a few reasons for that: one of them being I am working on becoming a funded trader via Top Step Trader, so I have set goals for myself, and once achieved, I am done for the day. I also spoke with a rep at Top Step, because their economic calendar of news reports to avoid were not aligning with my economic calendar. Turns out they are not as militant on this issue as I previously thought, which allows me to trade into a lot more news reports (so if I’m already in a trade I don’t have to bail – that was a big issue for me) than previously thought.

This past week I mainly stuck to trading the NQ. On Monday, due to restrictions via Top Step, I had to flatten a trade that worked – was not too happy about that. Was NOT a great start to my week, regardless of the fact that the trade worked. But when you start trading heavier size, you have to bear in mind that they have rules and loss limits in place; this forced me to re-evaluate my goals, and scale back a bit. So the main lesson I learned this past week: it doesn’t matter if you are on the right side of the market, you have to control the drawdown no matter what. Preserving capital is #1 priority.

Trade of the week

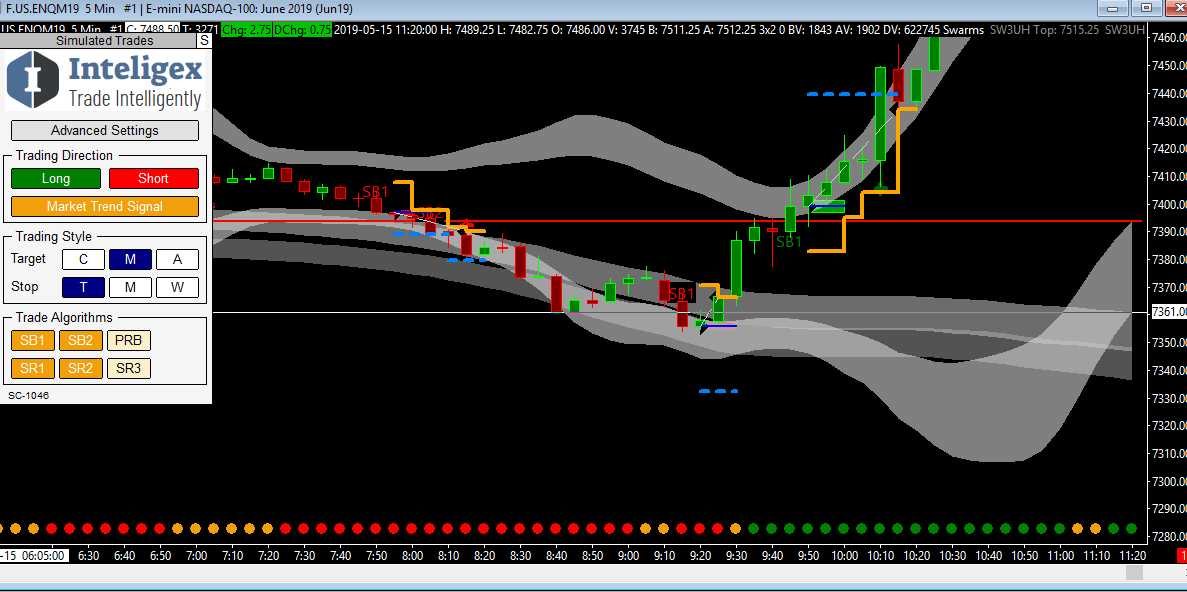

My favourite trade this past week that stood out for me: 5 min chart of NQ – Wednesday, May 15th. Long fired off at 9:45, and I entered at 9:50. Entered at 7400 and hit target of 7439. 39 handles in less than a half hour – thank you Inteligex!

I had a few losses this past week, but more gains – so, I finished the week on a positive note with minimal effort.

Looking forward to the new Inteligex Amethyst release, looking at the Telegram feed it’s getting some great results. Monday is a Canadian holiday, and I refrain from trading those, as I find volume drops off, but it also allows me time with family and friends!

Stay Green

Pam S.