From Red Monday to Green Wednesday

At Inteligex we are often asked if we are nervous when we trade and if we change our trading habits if we have a bad day or a good day.

The answer to both is no. Why? Because we stick to a routine that works. It works over time, and it works very well for us.

Let’s examine this week so far.

Monday was a dog, awful! A string of red on the performance sheet. We’re happy to show that because it’s what happened. No big deal. Our risk was spread, but we lost on every single instrument. Sure, small amounts but still losses.

What did the traders at Inteligex do to mitigate this? Absolutely nothing.

We stuck to the process, because we believe discipline works. Both in success and failure.

We stuck to the same hourly settings that we have used for months.

The same timeframes.

The same markets.

We checked our financial calendar as usual.

We let Inteligex run in auto trade mode as usual.

And the result? A simply bumper day. The only thing that changed was the markets.

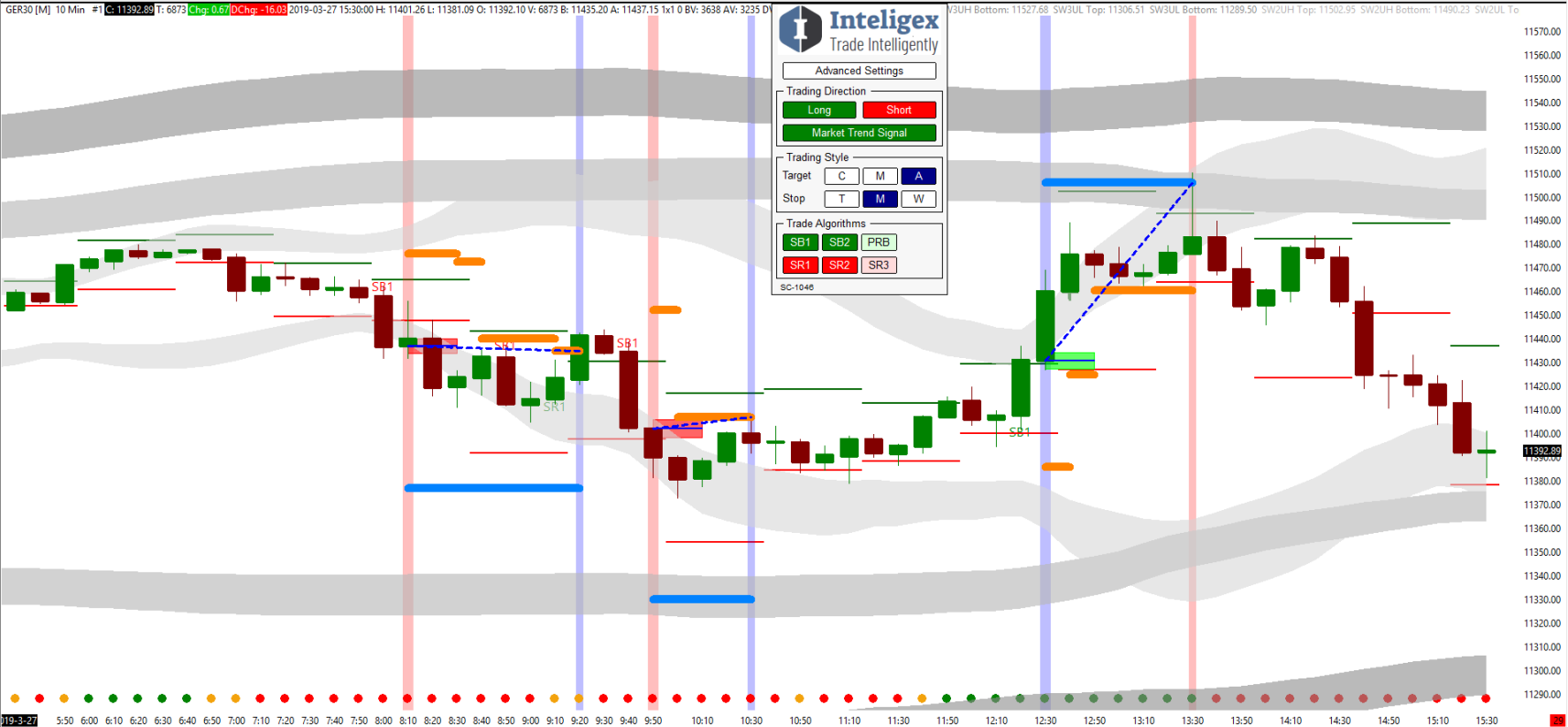

Here are a few charts from the day.

This is the Dax. 10 minute chart. We started the day with a very tiny profit. And then a very tiny loss. As usual we had a break set for the European lunch and then just after that lunch… we nailed a lovely long trade. With our target at the blue line, see how closely Inteligex predicted the move. The last candle retreated close to 20 points from the profit target, which was only 2 points under the high of that candle.

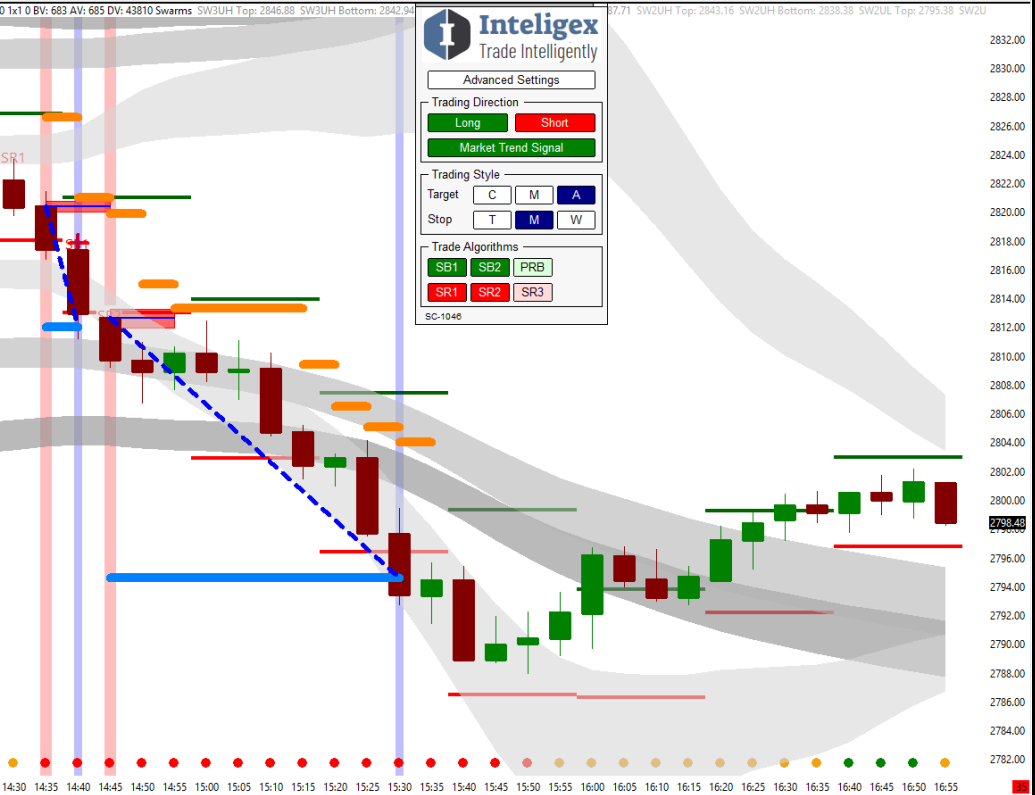

In the USA we had a lovely day also on both the S&P and the Dow.

In the S&P chart you can see clearly the two winning trades. Both exited on the target being reached again. Why didn’t we trade until stopped? Because with no news, no figures etc. huge surges are less likely to happen. And as we know we are pretty good at predicting the market, we just want to bank whenever we can.

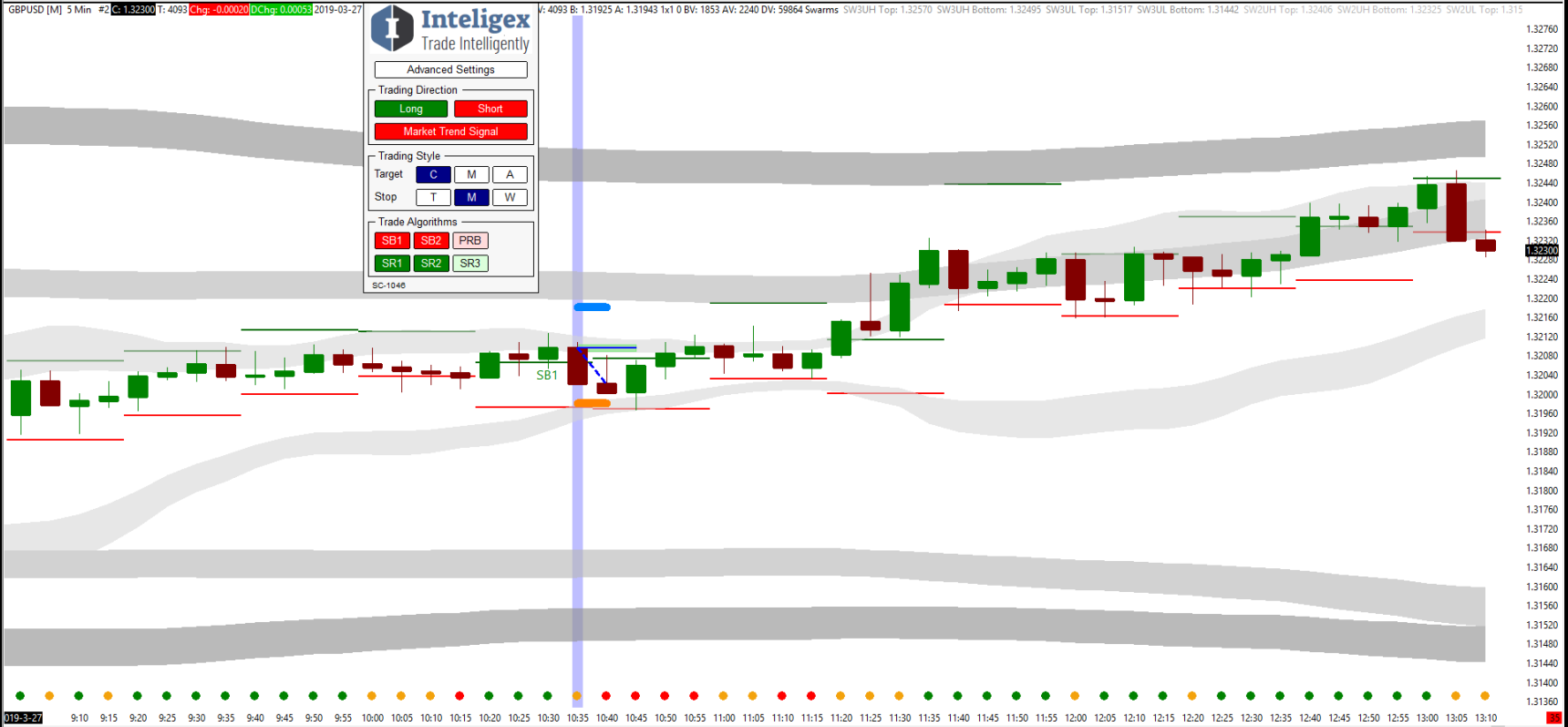

And now to the “dog of the day”. Cable. GBP v USD.

Brexit in our midst and what we see is a market that in theory should be doing something. That means we are trading in an unusual way. We are entering trades very conservatively (the [C] setting). We are running a [M]edium stop. In theory this should mean we receive 3-4 high probability trades a day. But check out the chart below. One trade in the day, and that was a loser. It was tiny, just a few pips, but a loser nevertheless.

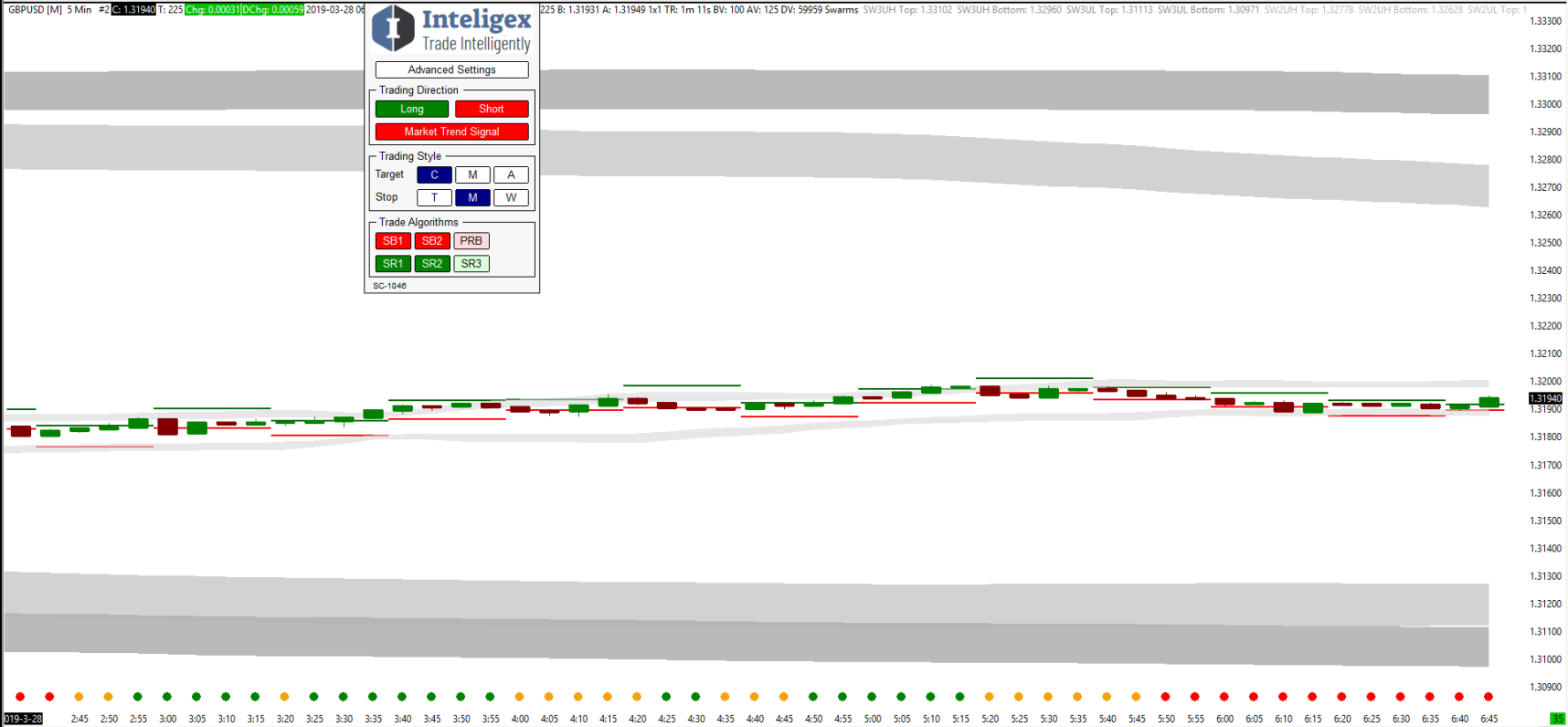

Now here is the crazy thing. Look at the next chart.

If this was a patient’s heartbeat, as a doctor you’d be thinking they were either dead or in a coma. Inteligex couldn’t find a single trade for 18 hours. Failure? Absolutely not. A total triumph.

As a person with many human failings (way more than most) I would probably have found 10 trades in that time. And lost on most of them. Inteligex though has no such emotional failings. It will do exactly what you tell it to. The Inteligex algorithms trade as you want them to trade. Learn to trade the Inteligex way and you will learn to trade better than many professionals. Trade without emotion. Trade with consistency.

Is Inteligex perfect? No way. We will keep spending the Intelgiex membership fees on bettering the product. Our goal is to evolve into a trading tool that allows us to compete with the hedge funds and institutions on a more than level playing field.

Learning to trade with Inteligex is a journey. We’re lucky to have some wonderful members and friends on that journey. The best bit? The journey never ends.

Peter and I will trade until we die and I hope beyond our deaths.

Peter from Heaven, and me from wherever I end up (there may still be time to join him).

How so? In the afterlife we intend to leave accounts open, to be auto traded according to set rules with all the profits being given to charity. A living legacy.

There is an old saying in trading, “see you on the other side”.

We intend that to be very true indeed.