On the Upward Grind

Hey Traders,

I wanted to share some plans Inteligex has before moving forward to a couple trades I took on Monday, March 11th.

First off, Peter mentioned that he wants to be ‘obsessed’ with providing the best customer service possible, so that each and every one of us has the best experience possible. Not easy to do, but it is definitely their priority! I thought that was worth sharing because we all want the experience of staying at ‘The Ritz’, as opposed to ‘Motel 8’.

Peter and Mark are working on providing weekly webinars, one to one set-up sessions with SeirraChart where required, and possibly offering a 1 hour session with yours truly, during week 3 or 4 of your trial.

Ok on to my trades

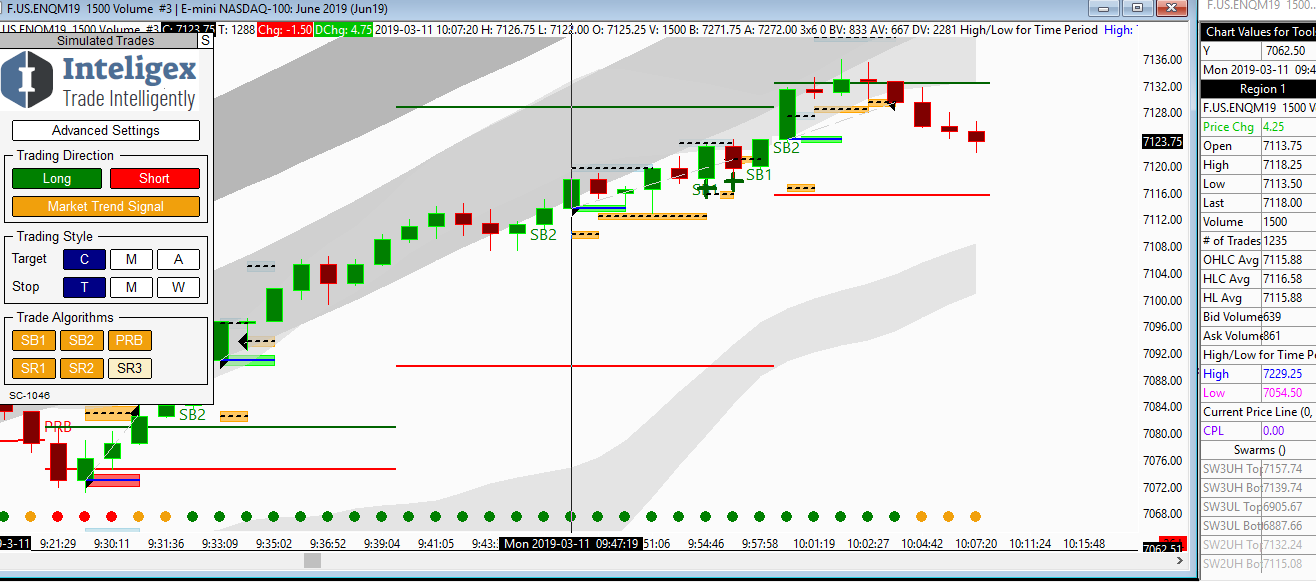

I’ve been focusing on Volume based charts recently, to experiment a bit, and also because I just plain like them.

So, will share a couple nice longs I took on the Nasdaq Monday morning. Why that day, when everyone knew it was an uptrend? Because how many times have you seen an uptrend, tried to get in, but it just kept slowly grinding higher, and you weren’t sure where to enter, and you weren’t sure where the top was?

Inteligex knew.

I’d typically struggle in the past with slow grinding uptrends, but not that day.

First long fired off at 9:56 – entry of 7114. I took profit at 7119. That’s 5 handles, or $100 per contract. Another long fired off at 9:56. Entered at 7123, and was still in the trade when yet another long triggered at 9:57. Held this one up to 7136. 13 handles, or $260 per contract. $360 in a half hour per contract.

As you’ll see from the chart I’ve now set up the line linking entry and exit points, I really like the clear view that it gives on every trade I take.

Of course not every trade works. I took my share of losses last week, but I still ended up GREEN. My favourite colour!

How have you been doing? Feel free to drop us an email, I’d really like to use my experience to help other Traders.