Happy New Year traders and welcome to 2019. This could well be the year of Trader AI (Augmented Intelligence).

That’s what we think here at Inteligex. Why? Because we recognise the power of human expertise and experience. So our latest software release, our most advanced yet, is designed to augment your intelligence not replace it.

Augmented intelligence (AI) is about helping us humans become faster and smarter at the tasks we’re performing.

That is exactly what Inteligex is doing, we want to make you a better trader whether you started yesterday or are a twenty-year veteran.

So, back to 2019 and what we see at the start of the year? We’ll cover a few basic charts here and more as the blogs continue.

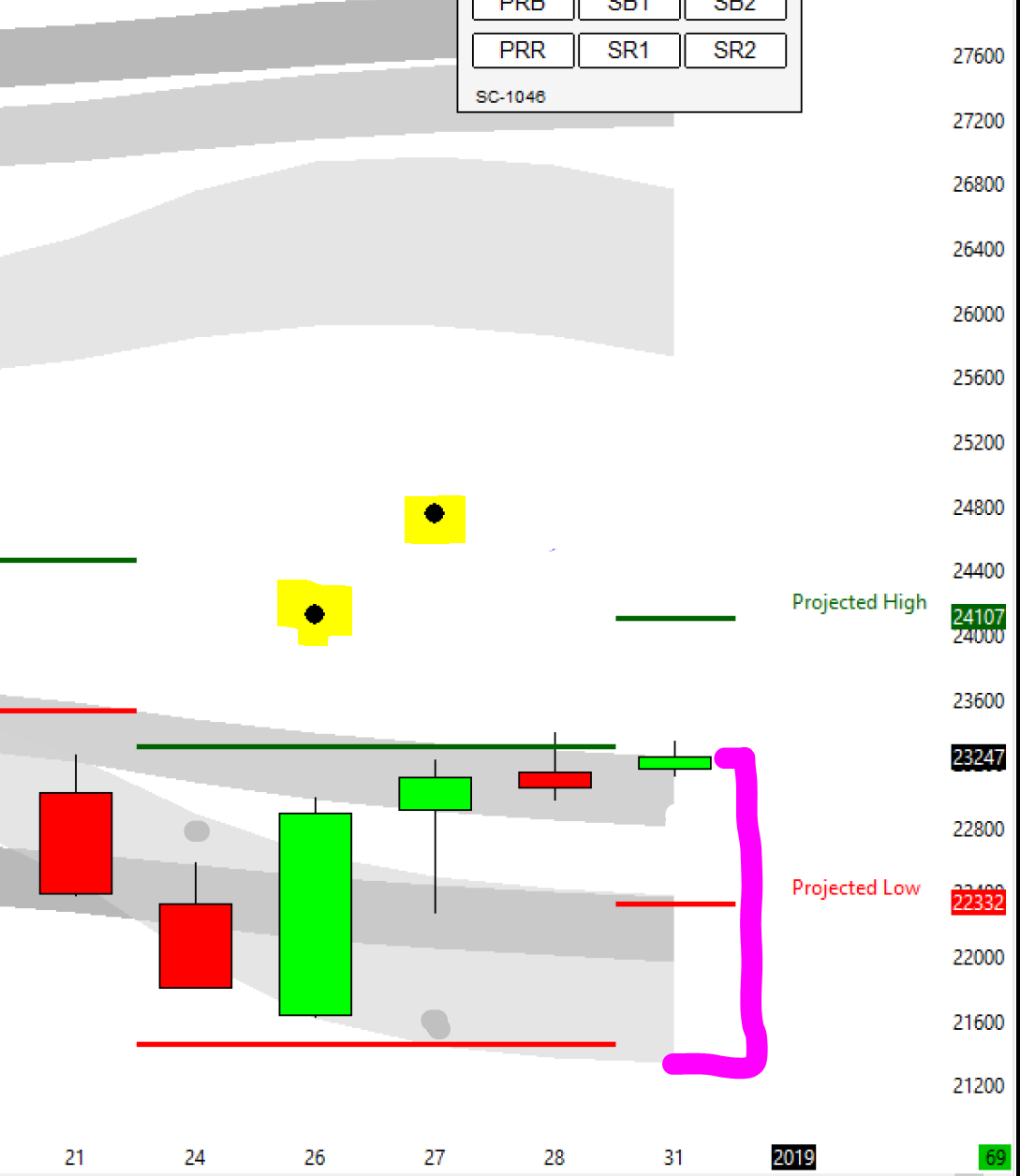

Let’s start with the Dow.

Not as widely trades as the S&P of course, but always a good instrument to trade and it attracts a lot of headlines so it’s worth looking at for both new and experienced traders.

Above is the daily chart and you can see from the shape and location of the swarms what we see as most likely this week.

The swarms above us are at 25,600 to 27,800 that’s a long way away from where we are now, which is resting on the SW2 swarm. In fact we are just above it.

The predicted range for the week gives us some room for a test of SW3 at 22,340 but we have a higher probability to pushing on to the 24,100 level as our next resistance point.

Intra day I am looking to take only SR2 reversal both short and long initially. I may well add a breakout trade after the first hours trading.

Things to note on the chart are the range of strong support from the SW1/2/3 swarms (in purple), plus the two predicted market targets of 24,100 and 24,800 (in yellow) if we close above 24,100.

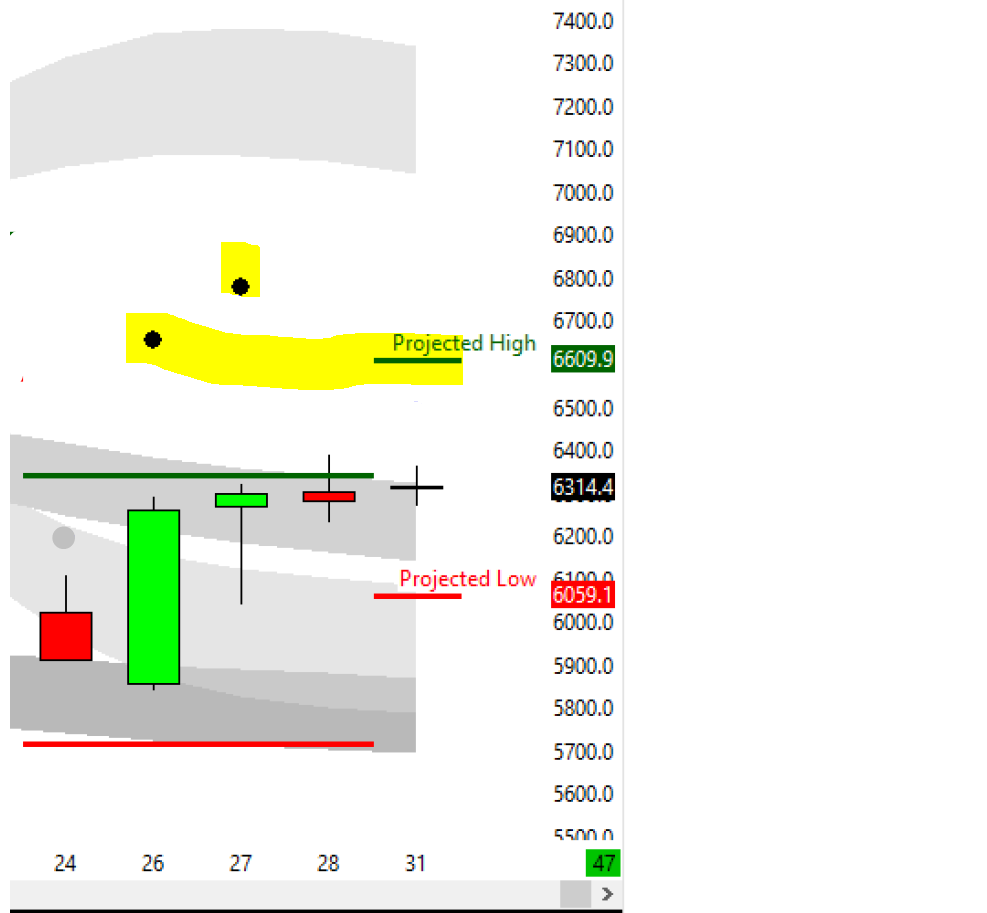

On the Nasdaq we have, as expected, a similar scenario.

Again we have a higher probability of a rise, but it’s by no mean certain.

The predicted target of 6664 (first dot) looks to be where the market wishes to get to, and as that’s about 300 points it could certainly be made by the end of the week.

We will be trading intra day again off of our high probability SW2 reversal trades and potentially setting breakout trades once we have an hour or so of trading under our belts.

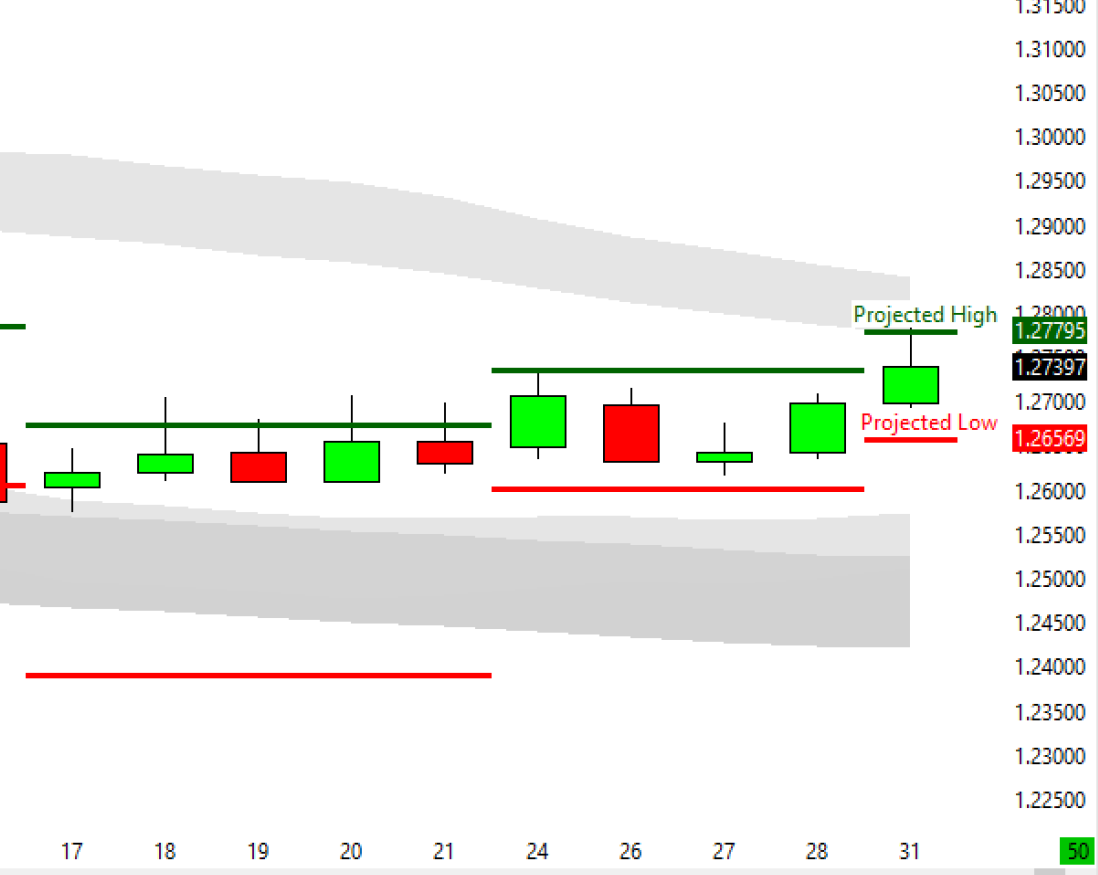

Currency wise, Cable (GBPUSD) has made a slight (1.5c) recovery since it hit the SW2 at 1.2550 eleven days ago.

It is trading in a small range, but again with the upside offering a slightly better opportunity than the short side at this time. The 1.24-1.25 base looks quite solid.

Maybe there will be Brexit breakthrough soon and we will get a breakout to the upside on the daily chart?

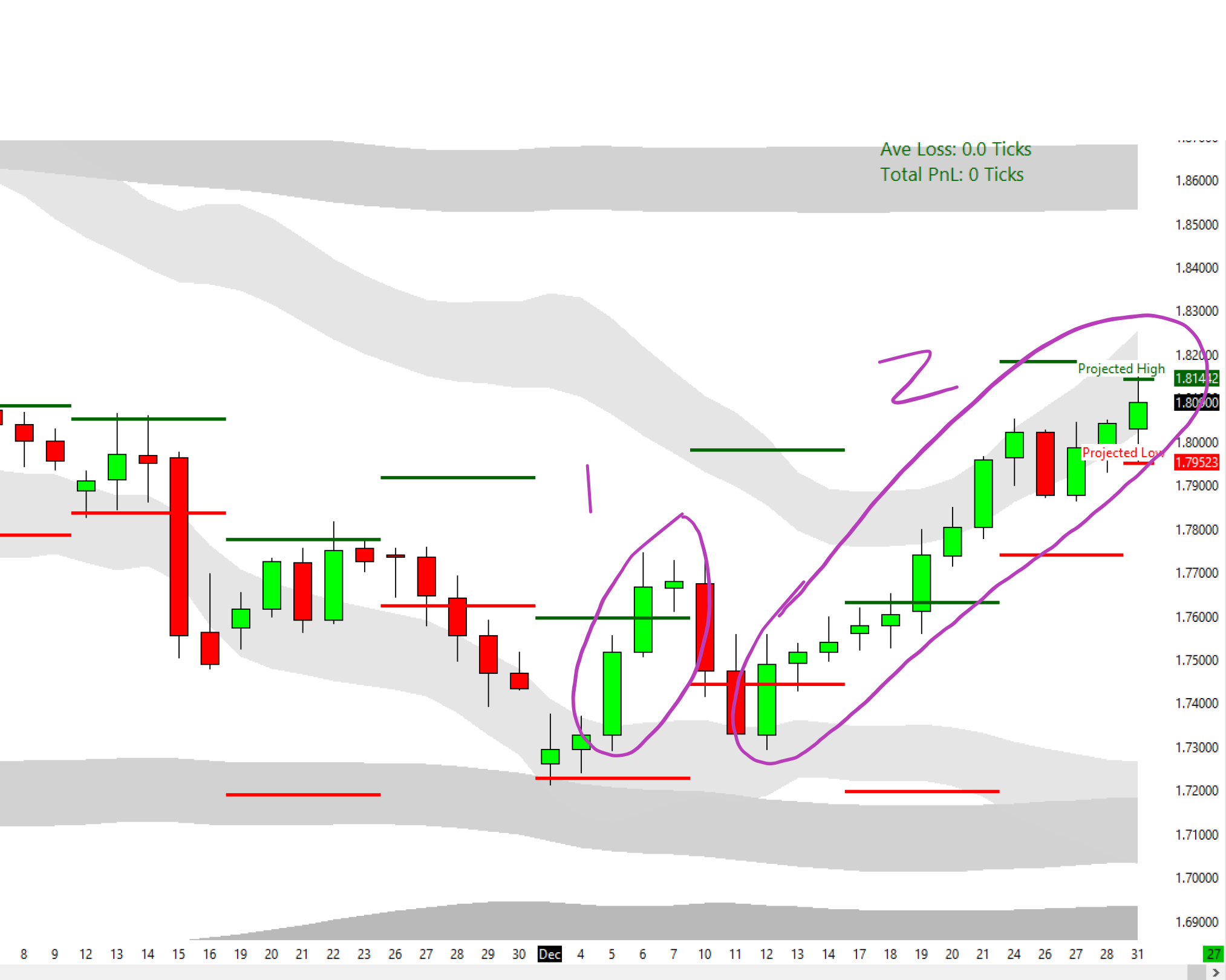

Sterling moving higher? Sounds crazy? Not really. Check out the GBP/AUD chart.

From the time we tried (and failed) to push through the SW1, GBP has had a rather meteoric rise, with 2 trades offered up. Both reversal trades.

Trade 1 was a break even. No problem at all. It happens.

Trade 2 is huge and still running with 600 pips already secured and … potentially more to come.

Maybe someone knows something and maybe not. All we know is the Inteligex Augmented Intelligence algorithms have put us nicely ahead in this trade.

And there we have it. The first blog of 2019.

This could well be a seriously interesting year. Years ending with a 9 often are in finance (or so the story goes). 1919? 1929? 2009?

1919? Yes. A century ago the Dow hit the heady heights of 119.6 at its peak, falling to 66.2 just over two years later, a huge 40%. The 1929 decline – 89% from the high of 380, to the low of 41.2.

We always think we are smart enough to avoid those types of events, yet in 2008 the Dow as only at 14,093 before dropping 40% to the low of 8451 in a little over a year.

Now? We are at 23,000. Whatever way it goes, we will trade exactly what the charts and algos tell us. We shall augment our trader intelligence and make profit by staying calm when others panic.

We wish you great success in 2019.