Inteligex saw it coming!

The markets have had a rough time in the run up to Christmas, dropping over 2500 points in seven days trading.

Inteligex users have had a field day, a very Merry Christmas!

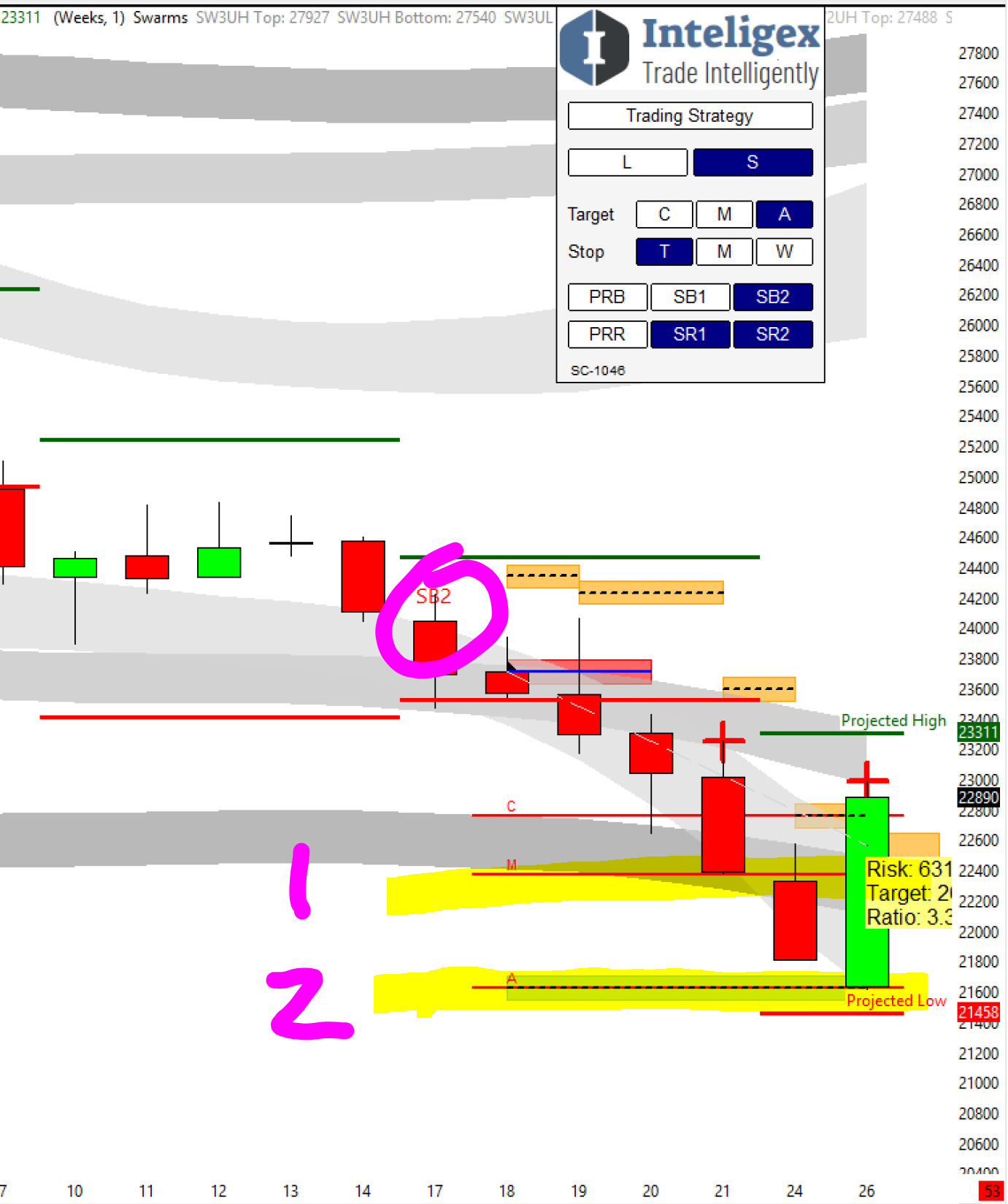

At the end of trading on Monday 17th December, Inteligex indicated an SB2 trade, that put us into “short bias mode”. At the same exact time, Inteligex predicted two turning points for the market. We predicted an aggressive low for the move of 21,627, and a moderate low of 22,384. Those forecasts were made at 10pm on 17th December (highlighted on the chart as 1&2).

So we had our predictions, but how did the trade play out? The moderate low was right in the Swarm 3 band, and so a good place to take at least some profits. If you had traded just the moderate target of this move, you would have banked a handy 1,347 points on the Dow or $6735.

So we had our predictions, but how did the trade play out? The moderate low was right in the Swarm 3 band, and so a good place to take at least some profits. If you had traded just the moderate target of this move, you would have banked a handy 1,347 points on the Dow or $6735.

The predicted aggressive low of the move was under our Swarm 3 band. That’s the point at which we see major institutional buying is likely to take place.

Inteligex predicted low? 21,627. Market actual low? 21,614.

Just 13 points difference over a seven day period. The results of trading the entire move are a stunning 2,104 points or $10,520 profit.

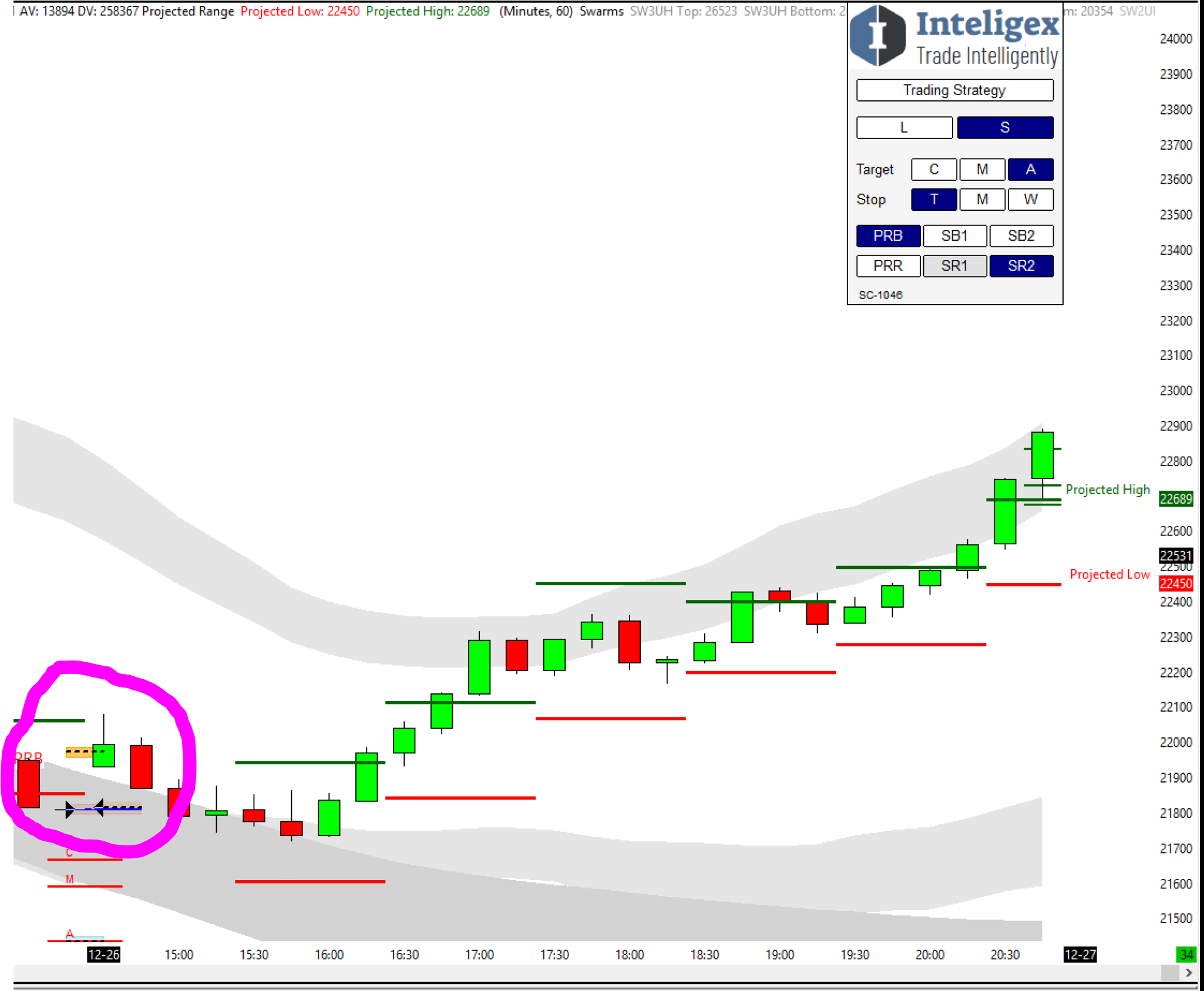

And then what happened yesterday? Well, daily we had no trade of course as all our targets were met. Intraday we ran with the usual long/short strategy. With no clear direction we look only for SR2 reversals so we trade at market extremes only.

This always means fewer trades, but is a sensible and cautious strategy to employ at potential market turning points.

Within 15 minutes we had a short trade signalled, and we took the trade. But the move never developed and we ended up with a scratch trade. No profit. No loss.

Exactly one hour after the short trade was stopped, the market looked to be moribund. Then, as we all know now, the touchpaper was it.

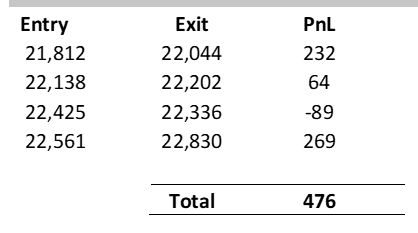

We have four trades signalled. Three winners and a loser. Net profit points? 476 or $2380 on a single contract of the Dow.

The full picture is of course on the chart above (including losses as always). The full entry and exits are in the table below. Overall a great day. We traded Long and short, cautiously.

On a day when just as many people were killed shorting into the greatest one day rise ever, we were not. We took fully 50% of the move, with a 75% trade win ratio over the day and an average win size of 2.1 times the loss.

Now that’s Inteligex trading!